|

The announcement that caught everyone’s attention yesterday:

President Biden officially announced a plan to offer student-debt relief in our country.Unfortunately the Government can’t forgive the other mistakes you made in college… |

The package has three major takeaways:

- Cancel $10,000 of Federal Student debt (private student loans are not eligible) for those making less than $125,000/year and $250,000/year for married couples or head of households. If you received a Pell Grant, you may be eligible to have $20,000 forgiven.

- Extend the loan payment pause for most federal student loans through 12/31/2022. The extended pause will occur automatically, there is nothing for you to do. This pause has now been extended seven times since being announced in March 2020, but Biden indicated this is the last time that the pause will be extended.

- Make the income-base repayment plans for manageable for current and future borrowers that are considered lower-to-middle income borrowers. Borrowers can now cap their repayments at 5% of their monthly income (down from 10%).

It’s been so long since borrowers had to think about their federal student loans that some student loan servicers websites crashed as people rushed to remember what they owed.

With any major announcement, there will be plenty of debate.

With midterm elections in November, Biden got the headline he needed. Many will point out that this can benefit up to 43 million Americans. Also, this relief will hopefully free up cash flow for borrowers to boost their savings and invest some of the proceeds into the economy (but this may not be good for inflation as we need demand to still come down…)

However, there are plenty of flaws to point out. With inflation still on everyone’s mind, this move is estimated to cost the government around $300 billion over the next 10-years. Additionally, the number of America’s with student debt skews wealthy and can send the wrong message to potential borrowers.

Not to mention the people who were fiscally responsible and already repaid their debts, no cake for them…

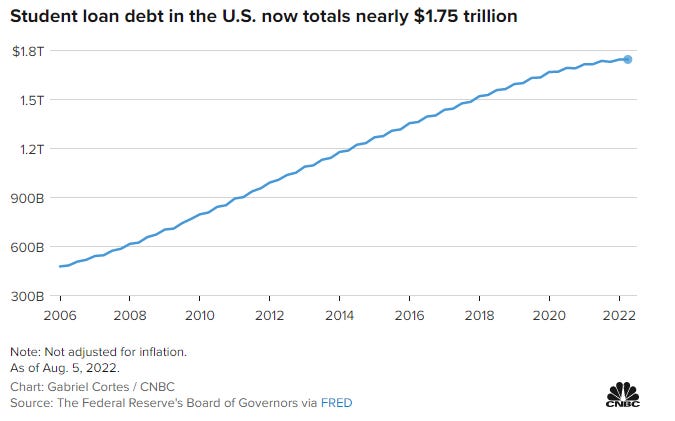

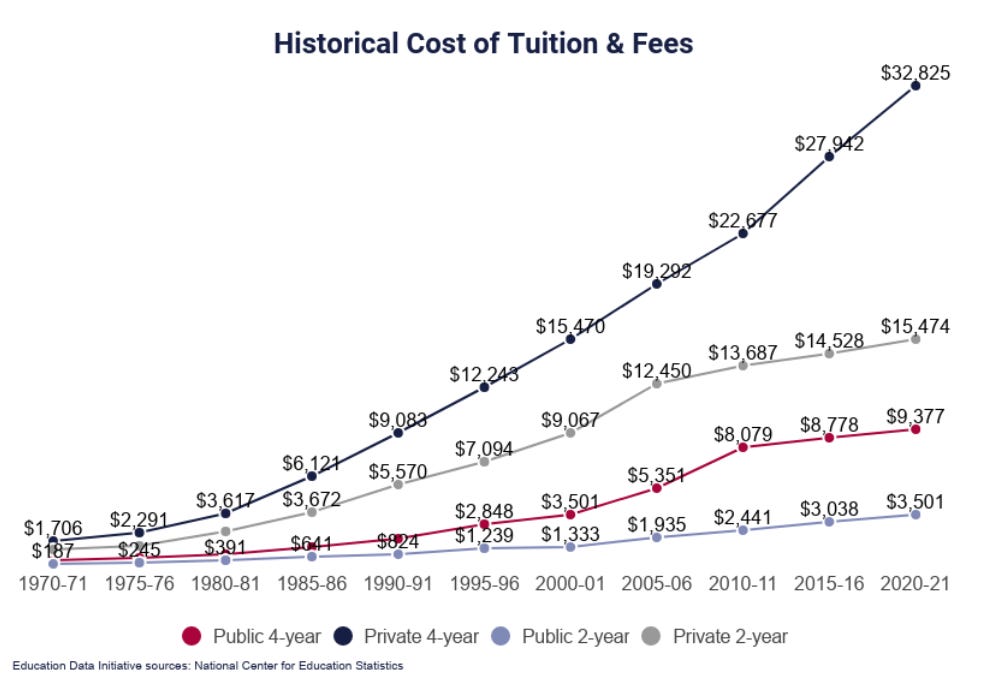

But something that I think we can all agree on is how absurd this student loan debt/cost of attending college has become:

This next chart shows the number of Americans with Student Loans (roughly 45 million) and the respective debts they owe:

The majority of Americans with student loans owe between $10,000 – $25,000. And yes, there are over 600,000 people in this country who owe more than $200,000 in student loan debt…

The major problem I see with this announcement is that there are no incentives for colleges to lower costs.

This announcement serves as a band-aid for a wound that needs hundreds of stitches.

Future borrowers will simply find themselves in the same spot if the price of attending college does not change.

I liked Ben Carlson’s proposal of just reducing the interest rate on federal student loans to 0%.

But, what’s done is done and now we must move forward.

So, for those that do have Federal Student Loans, what can you do now?

You will most likely may have to fill out an online application to receive the loan forgiveness. I’m assuming this will be to verify your income and other information.

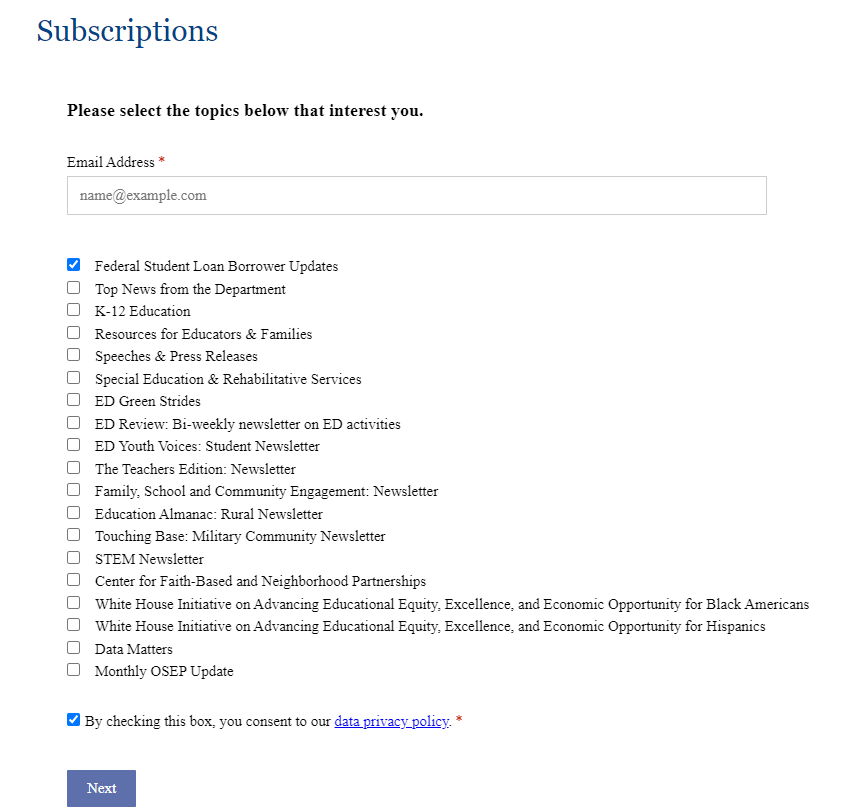

No exact date has been set, but the application will be available before the pause on federal student loan repayments ends on December 31st. You can stay on top of this by subscribing to ‘Federal Student Loan Borrower Updates’ here:

Although politicians frequently change their minds, I would get ready to resume making payments come January 2023. Make sure you know where your loans are held, as many loans have changed service providers.

Also, going back to my blog last week, did you know that most servicers offer a 0.25% rate discount if you set up automatic payments towards your student loans? No brainer.

For those borrowers that work in the public sector, specifically, non-profits, the military, or federal, state, Tribal, or local government, explore the Public Service Loan Forgiveness (PSLF) program.

You may be eligible to have all of their student loans forgiven through this program.

They have made limited-time changes that waive certain eligibility criteria so you could be eligible. These temporary changes expire on October 31, 2022. So, visit pslf.gov before 10/31/2022 to see if you are eligible for the Public Service Loan Forgiveness (PSLF) program.

Want more information? Here are a few helpful links:

What you need to know about Bidens Student Forgiveness Plan

Still have questions? Reach out to me directly!

Disclosure: This material is for general information only and is not intended to provide specific advice or recommendations for any individual.