Short story:

Finally, some good news. So far, Q1 EPS looks just fine. No clear tariff impact at the level of the S&P 500 index. Obviously, it’s still early to draw big conclusions, with only 15% of firms reporting. But the ratio of positive to negative EPS surprises is slightly better than average. With headline shock from tariffs largely priced in, a decent Q1 should help put a floor under the equity market. At least for now. And at least if they don’t take further action to hit the big tech firms that swing the index. The new ban on Nvidia chip exports hurts a bit. We’ll see that play out with read-across to other chip makers today.

Longer story:

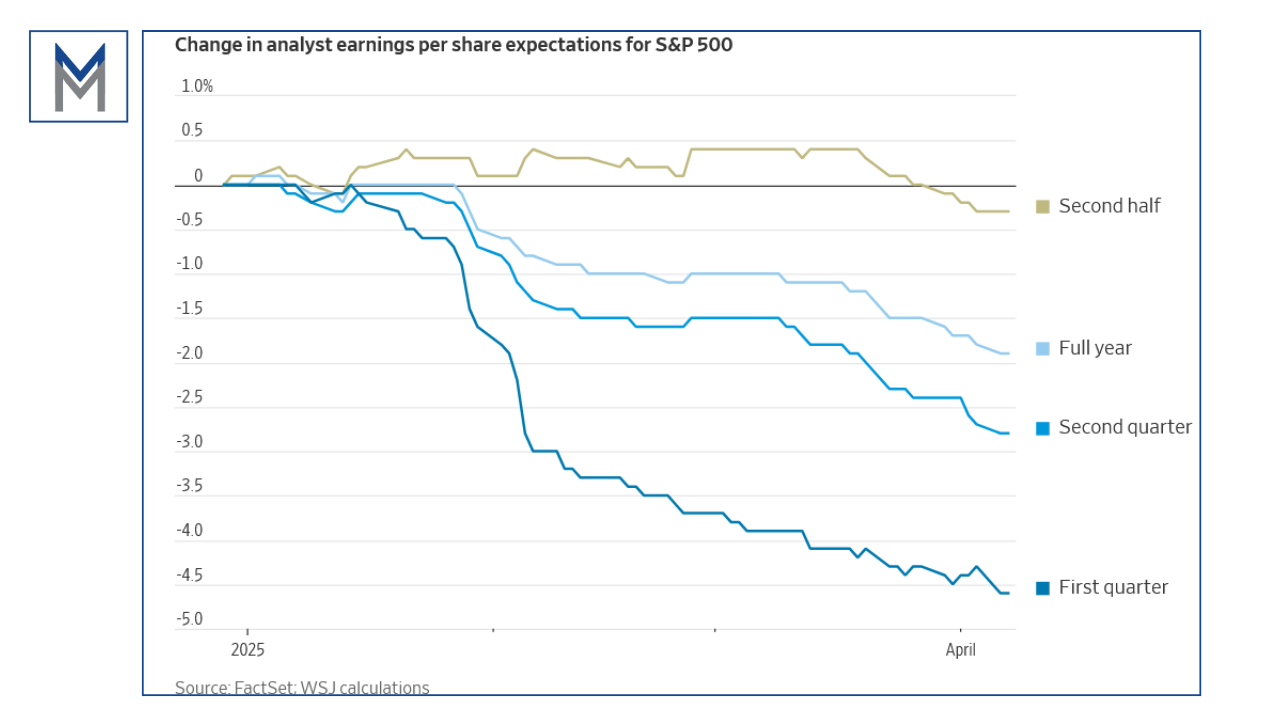

Analyst EPS estimates have been coming down pretty quickly recently, but they always decline a few percent leading into reporting. It’s also often the case that weaker firms tend to report later than the strong ones. But we take our good news where we can get it. It was never likely that tariffs would have a major impact on this quarter because of course, they mostly haven’t come into force, and those that are in force haven’t been in place for very long. But with a 90 day pause, we may not even see a broad-based impact in Q2. They’ve bought time for deal making.

As to deal making, it’s notable that we have a negotiating team from Japan in DC tomorrow. Quite unusually, Trump will sit in on some of the negotiations himself. Will this help things along? Maybe… Either way, it shows just how focused he is on making some progress. That seems appropriate.

The ban/restriction on exports of Nvidia’s H-20 chips and the 5.5b charge-off they’re taking is estimated to be a 7% reduction to revenues. These chips were designed to comply with prior export controls, but the goal posts have moved. Sales in China make up around 15% of Nvidia revenue.

Disclosure: This material is for general information only and is not intended to provide specific advice or recommendations for any individual.