If you are considering buying a house, a good place to start is knowing what’s affordable for you.

Most likely you will need to take out a mortgage to help with the purchase.

Banks will determine what’s a manageable number that you can afford on a monthly basis. A number of factors come into play, but this is predominately measured by your “debt to income” ratio.

Let’s say you make $150,000. Your monthly income is roughly $12,500 (pre-tax).

Then the bank will assess your monthly debt payments (student loans, credit cards, etc.).

In this example, let’s use $1,000 of monthly debt obligations.

$12.5k in monthly income minus your monthly debt payments of $1k = qualifying income of 11.5k.

Most lenders use a 45% DTI (debt to income ratio) so $11.5k x .45 = $5,175.

So the lender would allow your PITI (principle, interest, taxes and insurance) payment to be $5,175.

Depending on your down payment, interest rate, credit score, etc. you may qualify for a home that is well above $500k.

Now, this may surprise you for how much you qualify for. But just because you can, does it mean you should?

Understanding what the bank will lend to you is a good start, but it doesn’t take into account personal factors (i.e. you are going back to school, expecting kids in the future, like to go out to eat, etc.)

A general rule of thumb is to keep your housing costs around 30% of your gross income.

I would try and keep this number below 30% if this is your first home (your DREAM HOME may need to wait a few years and that is ok…)

Using the $150,000 income amount above, you should be cognizant not to spend more than $3,750/month (or $45,000 for the year) on housing costs.

Keep in mind the upfront costs associated with purchasing a home as well:

- Down payment – You don’t need to put 20% down but the more you put down the better (lower private mortgage insurance (PMI) or mortgage insurance premium (MIP), practiced habits to save up enough in cash, immediate equity in your home). You can put as little as 3.5% down (buy a $600k house, put 3.5% down, that’s $21k. Ensure you are comfortable with that and have the cash available.)

- Purchase & Sale (P&S) Agreement – Typically pay a home inspector fee and a small deposit may be due.

- Closing costs – Buyers can expect to pay between 2% and 5% of the purchase price on closing fees.

Now your done right? Well, not exactly.

The nice thing about renting is that your rent payment is typically the MAXIMUM you will pay during the month (maybe add in some utility bills).

But your mortgage is usually the MINIMUM you will pay each month.

Many home buyers do not take into account the “Phantom Housing Costs”:

- Furniture/Décor – I’ve learned nothing is cheap or easy to find.

- Repairs, maintenance, or upgrades – roof repairs, leaks, appliances break, etc. Not to mention the time it takes to find someone to fix the problem. A simple guideline for these costs is 1% of your purchase price every year.

- Any additional fees related to the specific place you’re buying (i.e. HOA fees).

I’m not trying to talk you out of buying a house. We all need a place to live and I do believe in real estate.

Just understand that buying a house isn’t guaranteed to be a great investment. Be realistic on what’s affordable.

You need to prepare for the worst but hope for the best. If your house goes down in value or you lose your job for a few months – can you still make the mortgage payments?

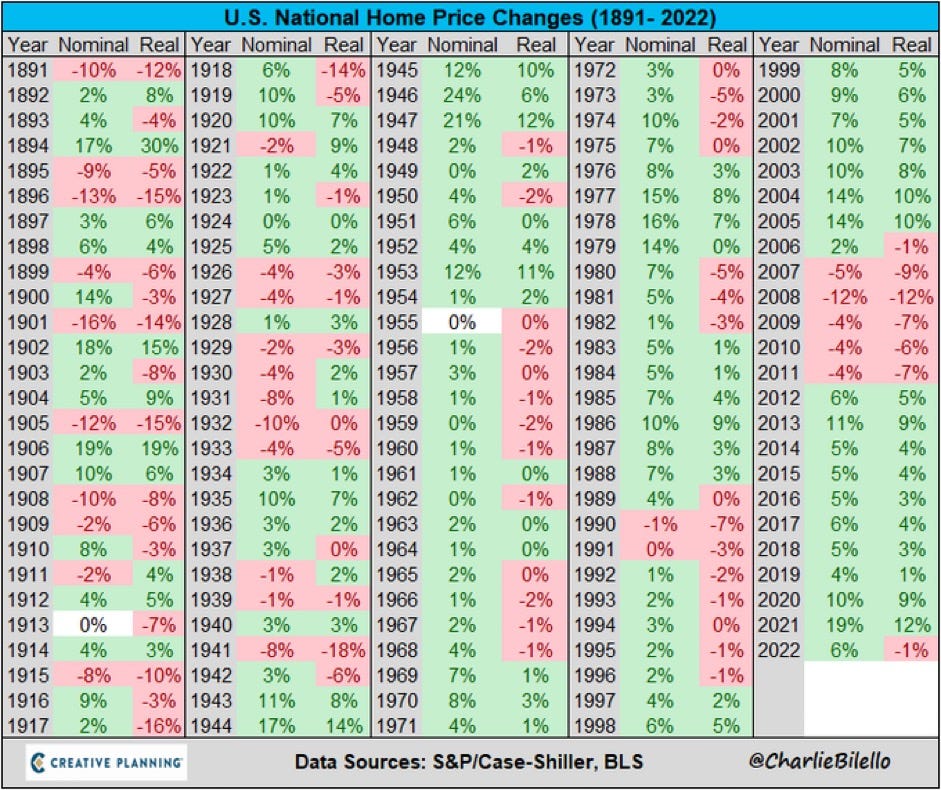

If your logic of buying a home is simply because housing prices always go up, this chart may dispute your claim:

Other tips when pursuing a home:

- Best place to save for an upcoming housing purchase is cash. Utilize a high yield savings account or Treasury Bills to earn a respectable interest rate while keeping your cash accessible.

- Focus on your credit score. Goal is to have a score of 750+. This will result in the lenders giving you much better rates/terms.

- It’s ok if you rent. I always hear, “I’m just throwing money away while renting.” I understand the logic, but renting still puts a roof over your head, can be much cheaper than a mortgage, and you don’t have to deal with all of the homeownership headaches.

- Utilize people you trust in this process. We have plenty of contacts in the mortgage/real estate field. Please reach out if you need contacts.

Disclosure: This material is for general information only and is not intended to provide specific advice or recommendations for any individual.