You’ve spent decades saving for retirement, now it’s time to transform your savings into a reliable income stream that sustains your lifestyle.

Historically, pensions were the predominant source of income for retirees. Providing a fixed monthly income that was essentially guaranteed for the rest of their lives. But the declining prevalence of traditional pensions has shifted the responsibility of funding retirement to individual savings.

For the median elderly household today, Social Security serves as their primary source of income.

–

Shifting Your Mindset – From Saving to Spending:

The transition from accumulating wealth to spending it can be extremely uncomfortable. You’ve been diligently saving, investing and growing your net worth for 30 – 50 years. Now you may be withdrawing a substantial amount each year and your net worth may very well have peaked; that freaks a lot of people out. But it’s time to embrace a new mindset focused on creating a plan for spending your hard earned money and enjoying your life.

Exploring Retirement Accounts:

Let’s start with reviewing some of the most popular accounts individuals use to save for retirement:

Understanding when and how to access your accounts is crucial.

Most retirement accounts are designed for access after age 59 1/2, with a 10% penalty assessed for early withdrawals, on top of the ordinary income taxes that you will owe regardless.

There will always be exceptions when you don’t have to wait until 59 1/2 and you may be able to explore the Rule of 55.

If you retire in your 40s or 50s, which accounts can you tap into without touching the retirement accounts?

Building Different Buckets for Flexibility:

Cash savings, brokerage accounts, real estate, and Roth IRAs can help you bridge this gap. This is why I’ve stressed the importance of building different buckets to give yourself flexibility and liquidity in retirement.

Having all of your money in IRAs comes with risks, especially if you need to cover nursing care expenses or want to have control on how much income you are showing on an annual basis.

Should you show a lot of income in retirement, you could incur higher ordinary income taxes and may even trigger the Medicare surcharge, which might be something you hadn’t planned for.

Adapting Your Plan:

Your financial plan will be dynamic and constantly evolving, it’s not stagnant. What you are spending today may change drastically compared to when you fully retire, but start to think about what position your are putting yourself into now. Other accounts may come into play such as Inherited Retirement Accounts from family members or close friends. This provides another source of income for you but may come with severe emotional conflict.

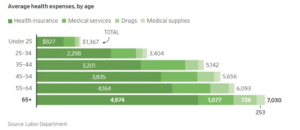

Yes, you can claim Social Security as early as 62, but if you are able to delay your benefits until age 70, then you maximize your benefits. So when is the right time for you to claim? HSAs can help cover medial expenses in retirement, in a tax-efficient manner. Medical costs tend to be one of the largest expenses for a retiree. If you are over 65, you could be spending over $7,000/year on medical costs:

Source

Prioritize your health and this could help lower these costs across your lifetime. Pay off major expenses or debts such as mortgages, car loans, roof repairs, etc. prior to retirement, as this will inevitably improve your monthly cash flow. As you continue along your financial journey, don’t go at this alone. You have worked too hard and saved a lot of money to just ‘wing it’. A well thought out plan minimizes the risk of unnecessary taxes and penalties and provides peace of mind. Please reach out if you aren’t sure how to turn your life savings into a retirement plan.

–

Disclosure: This material is for general information only and is not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results.

- All indices are unmanaged and may not be invested into directly.

- All investing includes risks, including fluctuating prices and loss of principal.