Introduction:

In a significant shift in trade patterns, the United States now imports more goods from Mexico than from China. This transition is highlighted by the latest data from the US Census Bureau, which underscores the evolving nature of international trade relations and the impact of geopolitical strategies on global supply chains.

Mexico’s Rising Role in US Imports:

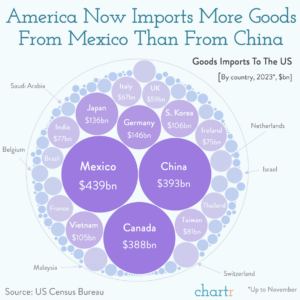

The numbers are telling: Mexico exported $439 billion worth of goods to the United States, outpacing China’s $393 billion, as recorded up until November. This marks a noteworthy change in the trade hierarchy, with Mexico taking the lead. The reasons behind this shift are manifold, including geographic proximity, trade agreements like the United States-Mexico-Canada Agreement, and companies diversifying away from China due to the trade war and other logistic considerations.

Comparative Analysis of Trade Partners:

The data presents an interesting comparison with other trade partners. For instance, Canada closely trails China with imports worth $388 billion, which showcases North America’s significant role in the US supply chain. Other notable contributors to US imports include Japan ($136B), Germany ($146B), and Vietnam ($105B), each reflecting their own unique trade relations and economic strengths.

*Chart sourced from Chartr.co

A Strategic Consideration for Investors:

For investors, understanding the implications of these trade shifts is crucial. The realignment in U.S. import sources from China to Mexico and beyond represents more than a change in trade flows—it’s an evolution in investment opportunities. The surge in imports from Mexico is more than a statistic—it’s a narrative of changing economic ties and supply chain reconfigurations. For investors, this could indicate growth opportunities in sectors where Mexico has gained export strength, such as automotive, electronics manufacturing, and agriculture.

Mitigating Risk in an Uncertain Trade Environment:

The shift away from Chinese imports underscores the necessity for investors to consider geopolitical risks when constructing a portfolio. The trade tensions between the U.S. and China have prompted businesses to diversify their supply chains, reducing the concentration risk associated with over-dependence on a single market.

Implications for Global Trade:

This shift has broad implications for global trade dynamics. The increase in imports from Mexico could be seen as a direct result of China’s turn towards a domestic-centric economic policy and the ongoing trade frictions with the US. It also reflects the strategic realignments by businesses seeking to mitigate risks associated with overreliance on a single country, thereby creating more resilient supply networks.

Summary:

The changing patterns of US imports underscore a pivotal moment in global trade. As Mexico ascends to become America’s top goods supplier, and China recalibrates its economic focus, we are witnessing a reshaping of the economic ties that bind nations. These developments signal not just a shift in numbers, but a deeper reconfiguration of international economic strategies, with long-term consequences for global markets.

–

Ready to make the most of your savings?

Our team at Munroe Morrow is here to help with personalized advice to optimize your retirement plan. Let’s work together to ensure your financial future is as rewarding as it should be. Take the first step towards a smarter, more secure retirement.

Schedule Your Free Consultation:

https://go.oncehub.com/mmwmgmt

–

Sources:

- https://www.trade.gov/usmca

- https://www.trade.gov/country-commercial-guides/mexico-automotive-industry

- https://www.trade.gov/country-commercial-guides/mexico-agriculture

- https://www.chartr.co/

–

The opinions voiced are for general information only and are not intended to provide specific advice or recommendations for any individual.