Short story:

Gold is setting new records and showing strong upward momentum, up 9% already this year. Miner shares have been moving at double that pace. Retail investors are showing signs of interest, and momentum is strong. Separately, the threat of tariffs and initiatives at the US Treasury are creating some weird, inside-baseball, kind of activity. There are reports that the vaults in London are empty, and derivatives are behaving unusually as a result. Very possible we could see continued big moves in the precious metals with spillover to related commodities and equities. Outlook positive.

Longer story:

Gold and silver had a terrific run last year albeit with lots of volatility and two big soft patches (July and then Nov/Dec). Miners have performed similarly but with even more volatility. Demand for these commodities is driven by different sets of players with relatively different agendas than those that consume other commodities. Retail “consumers” (especially in India and China, where gold is a traditional store of wealth) are one. Investors holding it for quick gains or portfolio diversification are another. Central banks, that hold physical gold as a part of their foreign currency reserves are the third.

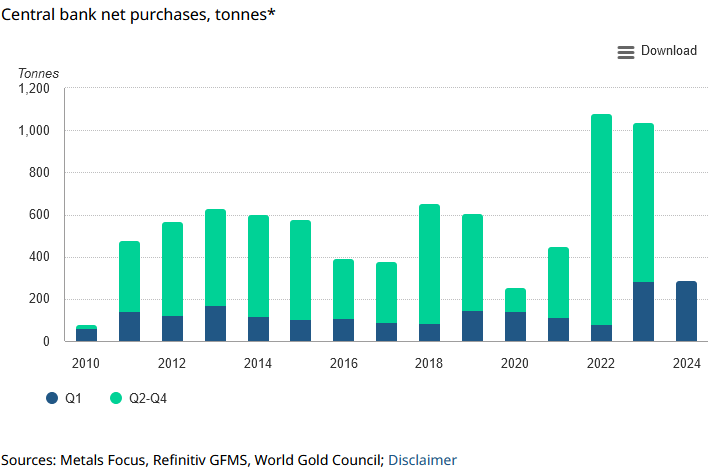

Last year’s rally seems to have been largely a result of central bank demand that began in 2022 and has continued apace. Particularly in China, Turkey and India. China is buying to get some of it’s reserves out of USD to insulate itself from sanctions in the event of a conflict over Taiwan and in response to the weaponization of the USD. Turkey and India seem to be buying more in response to excessive inflation.

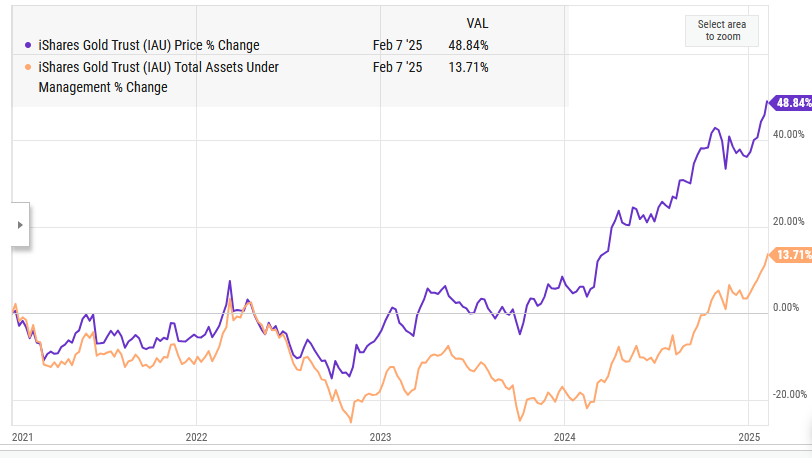

What’s starting to change may be interest amongst retail investors in the developed world. During the early days of the pandemic, gold attracted a lot of interest, but investors were subsequently disappointed when raging inflation and tense geopolitics failed to spark good results. A lot of retail investors also bought gold on the premise that the US Dollar was somehow compromised for political reasons, and that turned out to be wrong. The disappointment was exacerbated by the fact that US stocks did so well in 2021. By the end of that year, investors in the US were dumping their gold, as you can see in the spread between the price performance of the iShares Gold Trust (IAU) and it’s AUM. The two lines would have tracked in-line if net fund flows had been zero. This spread is now starting to narrow, showing that retail investors are starting to creep back in. This might be partly a result of worries about tariff-induced inflation, but it’s more likely simply that investors chase performance.

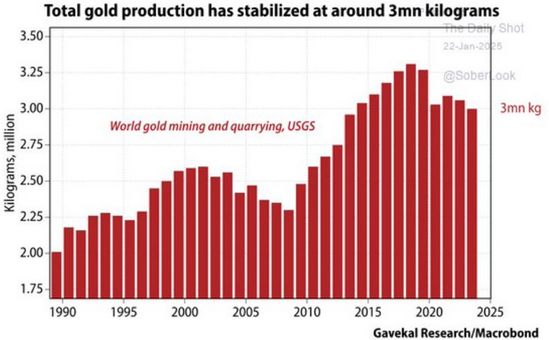

But it’s not just a demand story. I keep mentioning that investment into mining never fully recovered after 2016. As a result, this uptick in demand is coinciding with a decline in supply, as you can see in the chart below. This always happens with commodity booms and busts. They are long-cycle events because it takes so long to start generating new supply. Supply is inelastic over the short term.

Stranger Things

Separately, there are some weird things happening in the gold market. The US Treasury is noodling revaluation of America’s gold reserves (which are currently marked at $42/oz). Why? To improve the federal balance sheet and try to weaken the dollar. The way this could happen is that a stronger balance sheet might reduce the need for debt issuance would in turn reduce longer term yields (which the Fed cannot achieve). In reducing longer yields, the interest rate differential between countries and currencies might narrow, weakening demand for the greenback. I’m unclear as to whether this will happen or whether it would work out this way, but it’s a possibility. How would this impact the value of gold? Also unclear. But it’s notable that the administration would then have an incentive to talk up the price of gold. Coincidentally, Trump Media and Tech Group is now marketing a gold ETF.

Another strange political twist is to do with tariffs. Much of the gold that underpins gold futures or physical gold certificates is held in large underground vaults under key cities like New York, London and Geneva. These bars usually don’t move much. Ownership is just reassigned when a transaction takes place, domestically or across borders. But at the margin, sometimes net purchases and sales require settling up and moving bars. There is a fear that tariffs could gum that up and result in holders getting less than the true value of their gold when bars need to actually change location. In order to get ahead of this there has been a rush to move physical gold which has reportedly emptied (or nearly emptied) the vaults in London, creating unusual and possibly problematic distortions in derivatives priced off gold. If you hold a physical gold ETF, you may want to look at where the bars are held. If you’re investing in gold futures, be prepared for some weird price action.

If you want a really detailed discussion touching on the above two paragraphs, this interview with Jim Pulava goes deep.

All in all…

This all looks like a set-up for continued strength for precious metals. Until very recently, sentiment towards gold amongst retail investors was quite poor. It’s just beginning to turn more positive. All indications are that most investors hold very, very little of it. Unlike stocks or bonds, there really isn’t a firm “intrinsic value” to anchor upon that would lead you to say the price has gone upward too far too fast. Momentum tends to beget momentum, at least for a while. Lastly, related assets that theoretically should benefit from spillover of interest in gold, like gold and silver miners are at some of their lowest prices relative to the price of the metals – ever. They are truly hated by investors. It’ll be interesting to see if $3000/oz could thaw their hearts.

Disclosure: This material is for general information only and is not intended to provide specific advice or recommendations for any individual.